30 year conventional mortgage calculator

We calculated mortgage payments for the following home prices using a 10 down payment and a 5 fixed interest rate which was near the weekly average rate for a 30-year loan at the time of this. Conventional FHA Loan VA Loan.

Usda Loan Pros And Cons Understanding Mortgages Usda Loan Mortgage

The shorter your loan term the lower your.

. Refinancing from a 30-fixed FHA loan to a 15-year fixed-rate conventional loan eliminates MIP and helps slash interest charges. Historical 30-YR Mortgage Rates. Includes fixed 30-year mortgage rates for FHA VA and conventional loans plus advice to find your best rate.

The 15-year fixed-rate mortgage is the second most popular home loan choice among Americans with 6 of borrowers choosing a 15-year loan term. Compare those payments to the payments you get. You can practically get a 30-year fixed-rate loan from most mortgage lenders.

In the drop down area you have the option of selecting a 30-year fixed-rate mortgage 15-year fixed-rate mortgage or 51 ARM. The lowest down payment available for conventional mortgages is 3 for 30-year fixed-rate loans. You can use the following calculators to compare 10 year mortgages side-by-side against 15-year 20-year and 30-year options.

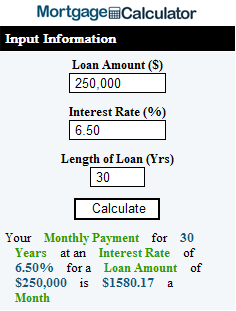

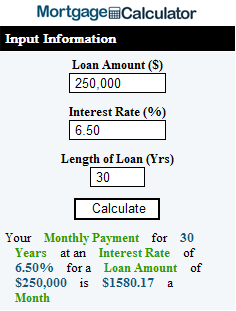

Current 30-Year Mortgage Rates. The surprise mortgage rate drop-off In 2018 many economists predicted that 2019 mortgage rates. By default 250000 30-yr fixed-rate loans are displayed in the table below.

How much money could you save. A 30-year fixed-rate home loan is a mortgage that will be completely paid off in 30 years if all the payments are made as scheduled. The most popular loan option is the 30-year mortgage but 15- and 20-year terms are also commonly available.

For adjustable-rate mortgages ARMs the requirement is. A 30-year fixed mortgage would have 360 payments 30x12360. The following table lists historical average annual mortgage rates for conforming 30-year mortgages.

As of January 10 2021 the average mortgage rate for a 30-year FRM is 265 APR while the average interest rate for a 15-year FRM is 216 APR. To get an amortization schedule for your 15-year fixed-rate mortgage use the calculator on top of this page. This allows you to secure a lower rate and pay your mortgage earlier.

In 2019 78 of borrowers refinanced from a 30-year fixed-rate mortgage into the same loan type according to Freddie Mac. Check out todays Federal Housing Administration FHA 30-year fixed refinance rates below. This means your interest rate and monthly payments stay the.

With a fixed-rate loan the interest rate remains the same for the entire span of the mortgage. Stability Youll be able to lock in the interest rate on your mortgage for the entire 30-year term. This home loan has relatively low monthly payments that stay the same over the 30-year period compared to higher payments on shorter term loans like a 15-year fixed-rate mortgageIf you prefer predictable steady monthly.

This is a very long time so make sure you can sustain payments even after retirement. A 30-year fixed-rate mortgage is by far the most popular home loan type and for good reason. But some of 2012 was higher and the entire year averaged out at 365 for a 30-year mortgage.

Use our free mortgage calculator to estimate your monthly mortgage payments. Conventional 30 year fixed. 10-year mortgages tend to be priced at roughly 05 to 10 lower than 30-year mortgages.

The 52-week high for a 30-year fixed mortgage was 6. Filters enable you to change the loan amount duration or loan type. For a 30-year fixed mortgage with a 35 interest rate.

15-Year Vs 30-Year Mortgage Calculator. On Tuesday August 30th 2022 the average APR on a 30-year fixed-rate mortgage fell 7 basis points to 5720The average APR on a 15-year fixed-rate mortgage fell 8 basis points to 4931 and the. If you can afford it consider taking a 15-year mortgage over a 30-year term.

When borrowers get conventional loans they usually take 30-year fixed-rate terms. And 7 went from a 30. Todays average rate on a 30-year fixed mortgage is 599 compared to the 596 average rate a week earlier.

Conventional 30 year fixed. You can obtain 30-year fixed-rate loans from the following types of conventional loans and government-sponsored. If youve taken a 30-year FRM you can refinance to a 15-year term after a couple of years.

The main advantages of a 30-year fixed mortgage are outlined below. Is a 30-year fixed-rate mortgage right for you. When talking about a 30-year fixed-rate mortgage it typically refers to conventional loans.

Another 14 went from a 30-year to a 15-year fixed. And once you decide on a 30-year term it means making payments for three decades. Conventional loans come in 10 15 20 25 and 30-year terms.

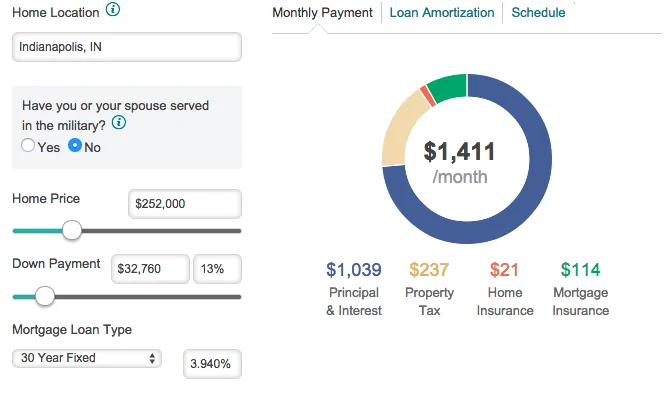

This gives you a degree of predictability you wont have with an adjustable-rate mortgage ARM. Mortgage Options That Offer 30-Year Fixed-Rate Loans. Home purchase price Down payment Property value Loan balance.

Todays mortgage rates in New York are 5603 for a 30-year fixed 5069 for a 15-year fixed and 5238 for a 5-year adjustable-rate mortgage ARM. Lock-in Redmonds Low 30-Year Mortgage Rates Today. The first two options as their name indicates are fixed-rate loans.

The longer term helps them afford lower monthly payments compared to 15 or 20-year loans. See todays 30-year mortgage rates. Some lenders even let you choose your own loan term for instance between 8 and 30 years.

Annual Percentage Rate APR represents the true yearly cost of your loan including any fees or costs in addition to. Bank mortgage loan officer can help you learn more. Most conforming conventional mortgages come with a fixed interest rate that is locked for the entire life of the loan with most home buyers choosing a 30-year payment term.

Compare current refinance rates today. Compare lenders serving Redmond to find the best loan to fit your needs lock in low rates today. Getting ready to buy a home.

However its important to know what options are out there so you can narrow down your search. Find average mortgage rates for the 30 year jumbo fixed mortgage from Mortgage News Daily and the Mortgage Bankers Association.

5 Best Mortgage Calculators How Much House Can You Afford

Mortgage Calculator

A Href Https Www Mortgagecalculator Org Calculators Should I Refinance Php Img Src Https Www Mo Refinance Mortgage Refinancing Mortgage Home Refinance

15 Year Mortgage Calculator Calculate Local 15 Yr Home Loan Refi Payments Nationwide

Pros And Cons Of Adjustable Rate Mortgages Adjustable Rate Mortgage First Time Home Buyers First Home Buyer

Mortgage Calculator By Digital Designer Calculator Design Mortgage Calculator Mortgage

Mortgage Payment Calculator Calculate Your Ideal Payment Mortgage Payment Calculator Mortgage Payment Mortgage

Fixed Vs Arm Mortgage Calculator Mls Mortgage Arm Mortgage Amortization Schedule Mortgage Amortization Calculator

Mortgage Calculator Script Free Mortgage Calculator Widget

Online Mortgage Calculator Wolfram Alpha

Mortgage Calculator Mortgage Calculator Reverse Mortgage Amortization Calculator Revers Mortgage Amortization Mortgage Amortization Calculator Online Mortgage

15 Year Vs 30 Year Mortgage 30 Year Mortgage Money Management Mortgage Payment

Mortgages 101 An Introduction To Interest Rates Infographic Mortgage Tips Home Mortgage Real Estate Tips

Simple Mortgage Calculator

Mortgage Calculator Mortgage Calculator Mortgage Amortization Schedule

The Math Behind The Mortgage Refinance Mortgage Mortgage Tips Home Buying

Iran Conflict Influences Drop In Mortgage Rates Fixed Rate Mortgage Mortgage Rates 30 Year Mortgage